In October, the market ended its negative streak and provided us with a very important lesson.

Quick summary

- A colossal rally helped the market end the month in green.

- It serves as a reminder that the crypto market is still extremely volatile.

- Altcoins are starting to gain momentum.

Market overview

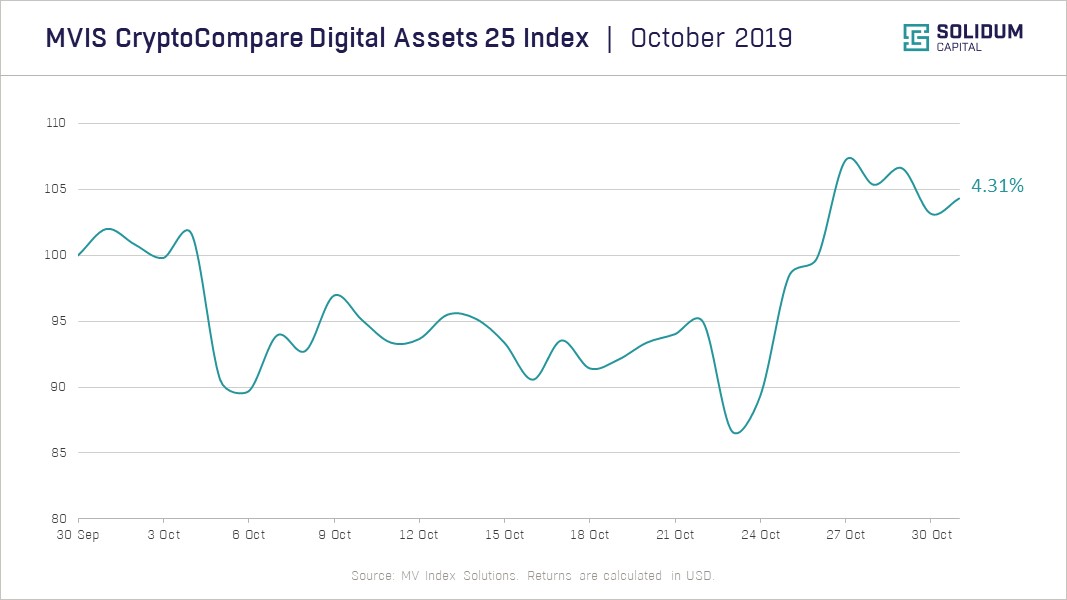

October was a special month in the crypto market and has provided us with a very important insight. The market was gradually losing value in the first 23 days of the month and lost 13.3% during this period. Then on the 24th, the Chinese president declared that blockchain was one of the national priorities which helped to spark a very strong market rally, leading many cryptocurrencies to gain more than 30% in a single day. I will expound this event and its lessons below. Eventually, the market managed to end its negative streak with a positive monthly performance of 4.3%.

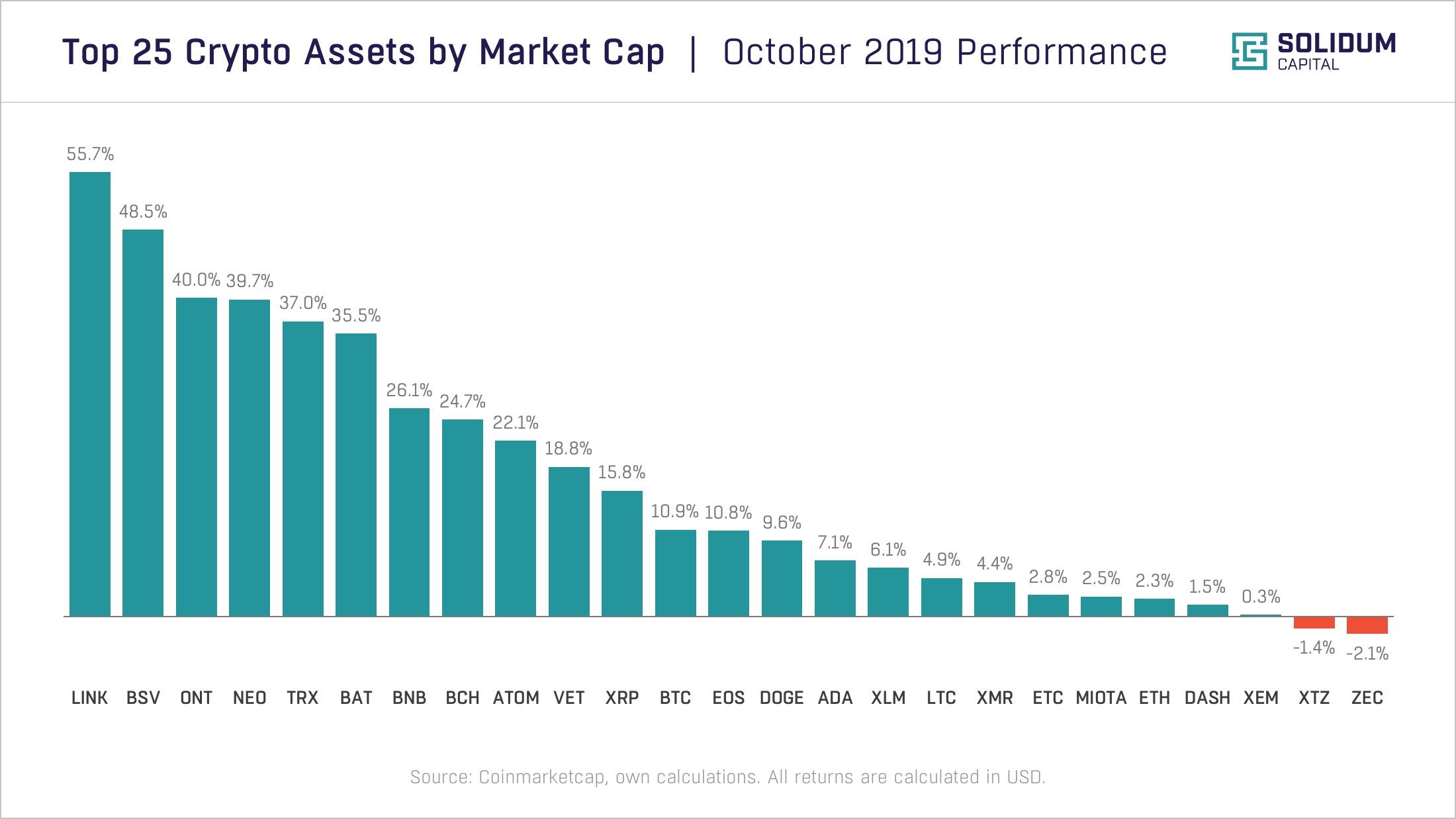

Bitcoin’s dominance started the month at 67.5% and was continuously decreasing until the above-mentioned rally occurred. It reached a low point of 65.5% on the 25th but ultimately succeeded to end the month where it started – at 67.5%. Yet despite this recuperation, several altcoins still outperformed Bitcoin for the second month in a row and, at least for now, it seems that the altcoins are starting to gain momentum.

Lessons from the market

Many market participants credited the market rally solely to the Chinese president, whereas in fact, there were several factors in play. Due to the prolonged period of market weakness, many crypto investors had started shorting the market. As the market continued with its decrease week after week, the short sellers were becoming more aggressive. A short squeeze was imminent and just a spark was needed for the market to rebound. This time, the crucial signal happened to have come from China.

Hereby, the most important lesson has been shown by an immense increase in prices that followed the event in less than 12 hours. During this short time, many cryptocurrencies gained more than 30% and Bitcoin appreciated by nearly 40% which was its largest single-day gain in six and a half years. This is an explicit reminder that the crypto market is still at a very early stage and is prone to massive movements in a very short period of time.

This time, the movement happened on the positive side. However, it could have easily taken the opposite direction – now imagine the market losing 40% in 12 hours. October’s shift is an admonition that such a colossal decrease can happen anytime and it is very important to keep this in mind when developing any crypto investment strategy. An old stock market saying goes:

Take care of the downside and the upside will take care of itself.

As with any other saying, its wisdom stems from real-life lessons which many have learned the hard way.

Traditional market participants are supporting the crypto ecosystem

At the beginning of October, the World Federation of Exchanges (WFE) asked the UK financial regulator FCA not to ban the sale of crypto derivatives to retail consumers – a move which they have been considering since July. This demonstrates that the traditional financial industry carries a very strong interest in the crypto market.

WFE members include global industry leaders such as Nasdaq, Intercontinental Exchange (ICE), and CME Group. Many traditional market participants have invested a lot of money and other resources into the development of crypto-related products and services, and the aforementioned expression of support is another clear indicator that the crypto is here to stay.

Adoption. And some more adoption.

Contrary to the opinions of some market observers, Bakkt is staying strong on its way to becoming one of the leaders in the crypto market. In my previous market commentary, I stated:

I remain confident that Bakkt’s volume will significantly increase in the future. It takes time for investors and brokers to accept the new product.

In October, Bakkt’s highest daily volume already surpassed $10 million and I expect this figure to continue rapidly increasing in the coming months.

The chairman of the US Commodity Futures Trading Commission (CFTC) stated that he believes Ether was a commodity (not a security). This statement should facilitate the development of Ether futures trading and represents yet another token of the crypto adoption.

Conclusion

In some market participants, the recent weakness of the crypto market has induced old fears about the future of this new ecosystem. Yet, many considerations in this commentary testify to quite the opposite – that the crypto is well on its way into the mainstream and already far beyond the tipping point. It is important to be patient and, as always, to have the appropriate risk controls in place.

Follow us on social media:

Facebook | LinkedIn | Twitter | Telegram | YouTube

DISCLAIMER: This article is for informational and discussion purposes only and does not constitute a marketing message, an investment survey, an investment recommendation, or investment advice. The article was prepared exclusively for a better understanding of market dynamics.

DISCLAIMER: This article is for informational and discussion purposes only and does not constitute a marketing message, an investment survey, an investment recommendation, or investment advice. The article was prepared exclusively for a better understanding of market dynamics.

Want to become a better crypto investor?

Receive our news straight to your inbox!

Want to become a better crypto investor?

Receive our news straight to your inbox!