Low volatility crypto environment

TL;DR:

- Our market view (mid-January):

- Short-term: Neutral

- Long-term: Negative

- It was a dull market for Bitcoin (and other crypto assets) in December.

- Binance FUD news was the main topic in the crypto community.

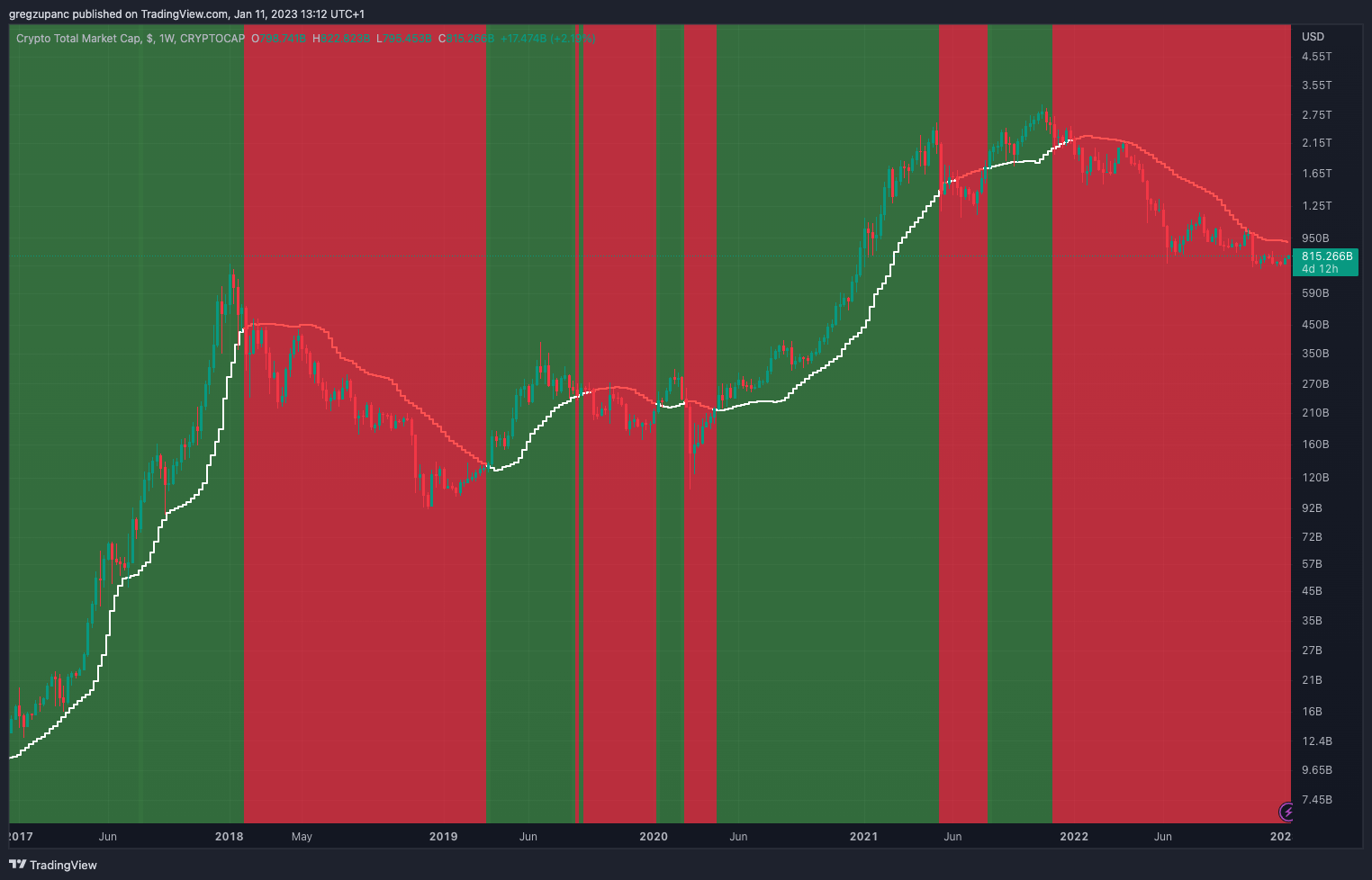

- The two widest crypto indexes, MVIS 100 and TOTAL, lost approximately two-thirds of their initial capitalization in 2022.

Market overview

November was a very volatile month due to FTX/Alameda collapse and the consequences that followed. On the other hand, December was the absolute difference with sideways price action and very low volatility. The price of Bitcoin has been stuck in a tight range between $16.5-17.5 with short-term deviations out of it.

The month was mainly in a post-FTX/Alameda collapse environment where Binance FUD news was the main topic in the crypto community, and we could see high volatility of BNB token. There were more than $9bn outflows in December from the exchange, but their operations haven’t been affected.

It seemed that everyone in the market was okay to close the hectic year in a low volatility environment. Price of Bitcoin managed to stay the whole month below crucial EMA lines. In early January, there was an attempt to move to higher price levels. The first resistance is at the $17.5k level, and if the price level goes above that, then 100-day EMA has to be challenged.

In the past posts, we’ve repeatedly mentioned that a 100-day EMA (white – currently at $18k) is crucial resistance. Before the last drop (November), its level was tested at $21k. The price was again denied, which confirmed a reliable trendsetter for Bitcoin in the previous months. Let’s see if, this time, the Bitcoin price can cross it.

On the other side, the chart shows more considerable support at a $12-13k level (red color). If this level doesn’t hold, the next support is at $10k (green color).

The year 2022 was one the worst in crypto history, and the total market capitalization of the whole crypto market decreased substantially. MVIS 100 declined by 65.5%, while index TOTAL lost 65.4% and closed the year at $756bn market capitalization.

We still recommend investors stay defensive and wait for more signs that we reached the bottom or at least a period of accumulation. Until Bitcoin price exceeds long-term moving averages (red and white in the chart) and those averages start turning the curve upside, there is no favourable risk/reward ratio.

Our market model is on short-term Neutral while on long-term time frame (still) Negative.

Follow us on social media:

DISCLAIMER: This article is for informational and discussion purposes only and does not constitute a marketing message, an investment survey, an investment recommendation, or investment advice. The article was prepared exclusively for a better understanding of market dynamics.